Saving Money Tip #158 - Do a Mid-Year Financial Check-Up. Just after the clock strikes midnight on January 1, millions of people around the world start working on their New Year’s resolutions. And if you are like many of those millions of people, one of those resolutions is to get out of debt, start saving more, or get a better handle on your finances. But we all know how resolutions often go. After the first few weeks, we often lose interest in them, change them, or plain forget about them. That’s why a mid-year check-up on your finances is imperative. It can help us get back on track, aid us in redefining our goals, or simply give us an update at where we are at financially.

At the end of last year, I urged everyone to set some financial goals and write-out a budget. If you are new to budgeting, it does not have to be an overly detailed form showing you where each dollar will go, but it at least should have the basic categories of your living expenses covered as well as an estimated dollar amount you expect to spend for each category. The budget is the means to reach your financial goals - where you want to spend/save your money and how much money you have to do so.

If you have made a financial plan and written a budget at the beginning of the year but haven’t done anything since then, then now is the time to do a review of them. Are your goals still the same? Do you still generally have the same spending ideas that you had 6 months ago? If your goals have changed or if your situation has changed, take a few minutes to update your goals and your budget. Perhaps you got a mid-year raise or you moved your child to a more expensive preschool that you hadn’t budgeted for. Make your necessary changes and then take a look at your overall financial picture. Are your current finances showing that you are meeting your goals? Or are you falling short? If you set out to put away $5,000 toward retirement, are you halfway there? Are you consistently putting $100 per month toward a mutual fund like you said you wanted to do at the beginning of the year? If you have money invested, are your investments performing the way you had hoped?

You generally shouldn’t need to make major changes to your budget or goals unless things have changed drastically in your life. If you have money in a mutual fund and it’s not performing well, it could be a result of market fluctuations rather than a poor mutual fund choice. Six months is too short of a horizon to make major changes. But it’s still a good idea to take a look at your investment choices at least once during the year. Tweak any budget changes, reevaluate your goals and get yourself back on track to where you want to be financially.

In Real Life (IRL) – I like to check on my finances 4 times per year – once per quarter. But not everyone needs to do that. Minimally, I think everyone should evaluate his or her finances at year-end and sometime in the middle of the year. It doesn’t have to be exactly on June 30, but that date often triggers financial statements from investment firms, making it a good time to check on your progress. At mid-year, I like to reevaluate the financial goals that I set for myself at the beginning of the year as well as our budget.

Our goals this year were to put away the maximum allowed by law into my husband’s 401(k). It is a little bit of a stretch for us, but since the money is taken out pre-tax, it makes it a bit easier. In addition, we set a goal of putting $2000 into each of our three children’s education accounts and $5000 each into my husband and my Roth IRA. With all of the rest of our income, we hope to just keep up with our expenses. To that end, we planned a budget that we thought was reasonable, detailing our expected expenses and the amount we wish to save. To date, we have kept up with our 401(k) contributions and have put away $6,000 of the $16,000 that we hope to do by the end of the year. Since it is mid-year, we are a bit behind, as we should be at the $8,000 mark. However, because my husband’s company got bought out, there are a few screwy things with his 401(k) contributions, so we expect his last few paychecks to be bigger than the ones at the beginning. Therefore, we still hope to make up the rest of our retirement contributions by year-end.

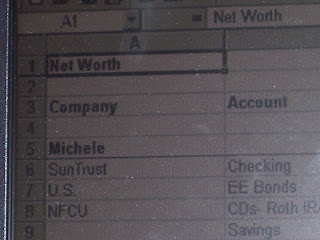

In addition to reviewing our budget and financial goals, I also complete a net worth spreadsheet at the end of each quarter. In it, I list all of our assets as well as our liabilities to show our net worth at four points during the year. Because of wildly fluctuating housing prices and stock prices, this net worth spreadsheet is only accurate for a given point in time. But in general, I like to see an increase in net worth from one quarter to the next, especially taking into account our investment contributions and payments towards our liabilities each month even if all of our investments are going down. I don’t have specific goals such as “I want to have a new worth of a million dollars by the time I am 50, but I do like to see how our net worth has climbed over the years. I will detail how to write up a net worth spreadsheet in my next post. Until then, take some time tonight or over the next few days to review your financial goals, tweak your budget if necessary and get back on track towards saving for a financially secure future.

3 comments:

Hi Michelle,

I love your thoughts on calculating networth (and your spreadsheet). I heart spreadsheets:)

I think it's great you are figuring out your networth! So many people that think they are doing okay would be really surprised to find out they have negative networth. It's a really good gauge to see how your finances are coming along.

Take Care,

Trixie

http://farmhomelife.blogspot.com/

Have you tried mint.com? It's great at tracking everything, including your net worth. I love Mint and find it SOOO much easier than Quicken or a spreadsheet ever was for me.

I have heard of Mint.com, although I haven't tried it. It probably is easier than starting a spreadsheet from scratch. But since mine is already set up, it's no big deal to enter my numbers each quarter. I will have to check it out sometime, though. Thanks for sharing!

Post a Comment